Payment system in the Republic of Macedonia

The Payment System before the Reform of 2001

Institutional Layout

The former payment system in the Republic of Macedonia differed for the natural persons from the one for the legal entities. The former were performing the payment operations through the banks, while the later were legally bound to have a single giro-account in the Payment Operations Bureau (POB) and to perform the payment operations through the POB. This account is opened with one bank, which uses the funds on the account for banking operations. The following pages provide a description of the specific part of the old payment system for legal entities.

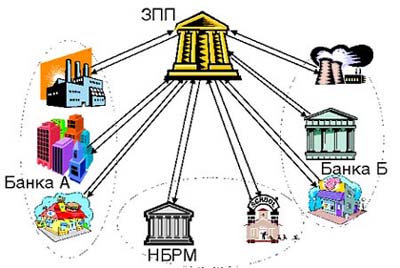

The structure of the former payment system can be presented in the following manner:

The chart presents a single-tier system in which all payments of the legal entities were performed through the POB. The payments were executed in the following manner: the initiator of the payment submits the payment order to the POB, then POB processes it and directs the funds to the account of the payee, after which the payment becomes final.

The legal entities were bound to submit their payment orders in a written form. This imposed the need of a direct contact, due to which the geographical diversity of the POB was of a great significance.

The previous settlement system, used by the legal entities, operated almost as a net settlement system: the POB played the role of a clearinghouse where all payments were processed, while the settlement was carried out in the National Bank. The only difference in this (net settlement) system was that the payments were final and irrevocable, even before the clearing and the settlement, which accelerated the system (value from the same day), however, involving considerable credit risk, systemic risk, operational risk, as well as liquidity risk.

Besides the clearing function, the POB also played the role of a “third party” - provider of services for the banks (including collection of payment orders, administration of accounts and preparation of reports for both the NBRM (for cash management) and the Government (primarily control function, tax collection, gathering statistical information). Furthermore, the POB had assumed a great deal of responsibility, such as treasury system for the budget, securities clearing, etc.

Processing of the Payment Orders

The clearing mechanism in the POB was based on the giro-accounts held by the participants in the payments system (over 100,000) in this institution. Each participant was required to have one (and only one) giro-account in the POB. Most of the participants were companies, other legal entities, natural persons, sole proprietors, banks and the NBRM. Nevertheless, the giro-accounts were only mirror-accounts of the current accounts of the participants opened with the banks and the NBRM, while the account balances were not within the competence of the POB. In the case of non-banking institutions, these accounts reflected their current account in a particular bank, while in the case of banks, their giro-accounts reflected their regular settlement account opened in the NBRM.

Unlike the practice in the developed market economies, where the payment orders are usually submitted through banks, the payment orders of the companies and natural persons, which choose to open an account in the POB, are submitted directly to the POB. The POB received the payment orders from 7:30 A.M. till noon each working day from Monday to Saturday. After the verification of the balance of the payer’s giro-account, the POB debited it, and credited the payee’s giro-account. These recordings were legally irrevocable and final.

The system was fast enough to ensure processing of the payment orders in the same day. Regionally, the POB operated through a network of branches (in the cities) directly linked with the central office. The POB prepared and provided daily bank statements for the bank clients and their transactions executed on the previous day. Apart from all this, the POB also supplied some companies with information on the balance on their giro-accounts through direct links, in several-hour intervals during the cut-off period. The POB identified and prevented any debt position on the giro-accounts of the bank clients.

Regarding the giro-accounts of individual banks, the POB registered the initial balance each working day, the net outflow or inflow on the basis of payments processed in the processing period and the final balance. The POB informed the banks on the final balance on their giro-account around 07:00 P.M. Starting from March 1996, the NBRM required from the banks with a negative balance on their giro-accounts at the end of the day to eliminate them in the period between 07:00 A.M. and 08:00 A.M. on the next day, or through the interbank Money Market, or by debiting their compulsory reserve accounts within the limit prescribed by the NBRM (40%). Since this bore considerable risk for the NBRM, starting from April 1998, the NBRM required from all banks to settle their negative balances at the end of the processing period. Since it was pretty late for using interbank credits, the only possibilities available to them were the following: usage of compulsory reserve not more than 40% (later on, it was increased to 60%), borrowing from the Central Bank and SWOP transaction USD/MKD for one day.

The banks had no information regarding the movements of the funds of their clients till the next morning when the POB informed the banks on the final balances of their clients for the previous day.

Around 07:00 P.M., the POB also informs the NBRM on the cumulative changes in the banks’ giro-accounts and initiates settlements in the NBRM ledgers. If, in the settlement period, it turned out that the bank’s initial balance was not sufficient to meet the settlement requirements, the NBRM would have been forced to allow an overdraft for that particular bank in order to enable it to complete the settlement. The settlement guarantee that the NBRM provided was integrated in the manner in which the system was established where the payments became irrevocable and final immediately after being processed by the POB.

While the former payment system provided fast and secure infrastructure for payments processing, it also created numerous problems from the aspect of both the NBRM and the banks and the public.

First Reform of the Former Payment System

In October 1997, the NBRM passed a decision according to which the large-value payments (over Denar 5 million; or over Denar 3 million since April 1998) are to be executed through the commercial banks. This measure which required processing of the large-value payments through banks was intended to assist in developing closer relations between the legal entities and their banks and simultaneously to acquaint the banks with the practice of submitting the large-value payment orders to the NBRM, or the RTGS system, nowadays. Even more important is that this procedure provided the banks with an access to more useful information on their expected obligations for settlement earlier in the day, thus helping in management of their liquidity and stimulating the development of the interbank Money Market.

According to this Manual, the cycle of processing the large-value payments was the following:

-

The large-value payments were to be submitted to the banks not later than 11:00 A.M.; the banks carried out division of payments in the system of their bank and outside the system;

-

The banks submitted the original payment orders within their systems to the POB not later than 12:30 P.M.;

-

The banks submitted the information on the payment orders within their system to the NBRM by e-mail on a special form containing no information on the ultimate payee of the funds; the NBRM calculated provisional balance for each bank from the large-value netting on the basis of these large-value orders;

-

The information on these clearing balances was sent to the banks not later than 12:30 P.M.; the banks having negative clearing balance on the basis of large-value payments were to settle them by:

-

agreeing on interbank loan (bilaterally or with an assistance of the Money Market);

-

selling foreign currency or bills of the Central Bank or other bank;

-

borrowing from the NBRM; or

-

using funds from their compulsory reserves (not more than 40%).

If the bank had not been able to settle its balance through either of these mechanisms, it would have been required to retire the large-value payments from this large-value payment clearing, taking into account the existing priorities for executing payments, stipulated under the Law on Payment Operations, and if the payment orders had been of a same priority, the time of receipt by the bank would have been taken into account.

-

The banks were required to inform the NBRM on their transactions for providing coverage not later than 01.45 P.M., or to send revised payment order (for withdrawing the payment orders);

-

Not later than 02:00 P.M. the NBRM calculated the final balances of the banks on the basis of large-value payments, informed the banks on the number of approved payment orders and gave orders to the POB to process them;

-

The banks submitted the original payment orders to the POB for their processing, not later than 03:00 P.M.

In April 1999, the NBRM reduced the amount of large-value payments to Denar 3 million.

However, this reform was only an introduction to the comprehensive reform of the payment system which started in June 2001.