Skopje, 26 March 2009

PRESS CONFERENCE OF MSc. PETAR GOSHEV, GOVERNOR OF THE NATIONAL BANK OF THE REPUBLIC OF MACEDONIA - MARCH 26, 2009

I. For longer then one decade now, the National Bank of the Republic of Macedonia has been successfully implementing the strategy of retaining the stable foreign exchange rate of the denar, through a successful mix of prudent monetary and fiscal policy. The choice for this strategy is not incidental. Macedonia is a small, fully open economy and extremely import-export dependant and unfortunately highly euroized country. Historically, it had suffered high inflationary as well as hiperinflationary schocks, which are deeply curved in people’s memory. For such characteristics of the economy and with such negative experiences, the stable foreign exchange rate of the denar has a tremendous importance for the price stability and for the positive expectations of the economic agents related to macroeconomic environment. Since none of the stated characteristics of our economy has not been changed, we in the National Bank of the Republic of Macedonia deeply believe that following up with the existing monetary strategy - keeping the stable exchange rate of the denar, as the main anchor in the economy - should continue. This means, i.e. let me repeat once again, that we continue to defend the stability of the foreign exchange rate with all instruments and measures available as of the monetary institution.

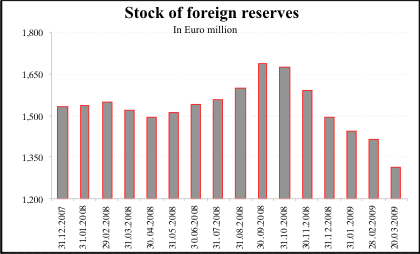

II. In accordance with this strategy, during the past period, i.e. starting at end-2007 and during the whole of 2008, being concerned first of all because of the growing inflation but also of the growing deficit of our economy to the rest of the world, we undertook a number of measures for tightening the monetary policy. However, in the meantime, the world crisis has deepened. In the fourth quarter of 2008 it started delivering to us high „paying invoices”. The demand as well as the prices for our main export products dropped dramatically . This continues even stronger in the first quarter of the this year. At the same time domestic aggregate demand (stimulated by the wage and pension growth, higher budget consumption and the high credit growth) was not appropriately and timely accommodated in accordance with the foundations of the economy. The trade as well as the current account deficit were growing, without being followed by the appropriate inflows in both, the capital and the financial account in the balance of payment. Practically, imbalances and pressures on the foreign exchange market were growing and so continue to grow thus being increased by the not that seldom carelessness or by, I even don’t exactly know what, other reasons, in creating numerous well founded negative expectations related to the foreign exchange rate stability. Because of all that, in order to maintain the equilibrium in the foreign exchange market in the last quarter of 2008 the foreign exchange interventions of the National Bank of the Republic of Macedonia, through net sales of foreign exchange, amounted to Euro 162.3 million while for the period January 01 - March 20, 2009, they amounted to Euro 181.0 mill. also on net basis. This is what actually enabled maintaining the existing foreign exchange rate level. As unfavorable developments in foreign trade continue and happen within high uncertainties for future capital inflows and net private transfers, as well as under psychological pressures over the citizens that direct them towards swapping national into foreign currency, we are of an opinion that further change in the monetary policy of the National Bank of the Republic of Macedonia is needed. Namely, although the registered inflationary drop, when observing just this indicator, indicates lower risks, still the pressures over the foreign exchange rate (as an intermediate objective of the monetary policy) and the growing risks of further widening of external imbalances, clearly seek from us to increase the restrictiveness of the monetary policy. For these reasons, we decided to raise the interest rate on the Central Bank bills by 2 percentage points that is becoming effective from the next auction, i.e. instead of 7 percent into rate of 9 percent.

III. Broader explanation of the reasons for passing this decision is the following:

1) Negative effects of the world crisis over the world economy continue to grow. The latest IMF projections point out that the world growth will switch towards the negative zone thus in 2009 world’s GDP will drop between -0.5 and -1.0 percent. This will represent the first negative GDP growth rate within last 60 years. The reduction of the world’s GDP below the potential, together with the downward trends of food and energy prices, by themselves not only eliminate the inflationary pressures, but also create deflationary risks, especially in the developed economies. Unfortunately, continuous revisions of the projections of the world‘s growth are further towards deeper recession.

In the less developed economies, including ours, the external sector risks appear as most essential, where the large reduction of the external demand as well as the lower inflows and/or larger net foreign capital outflows create serious pressures over the value of national currencies.

2) Macedonian economy, as we stated, is under a strong influence by the global macroeconomic developments. As almost everywhere in the world in our case as well the inflationary pressures fade and the economic growth decelerates because of the reduced external demand, contracted and more expensive financing sources and increased negative expectations of economic agents. The external sector imposes itself as a main problem of our macroeconomic policy. It is way too vulnerable, due to high presence of exports in sectors exposed to changes in world prices and world demand as well as due to significant reliance on private transfers as source for financing the trade deficit. Additional problem is the approach to external financing. It is less available. Expenses increased. Investors have either lost their capital or they are waiting for better and less risky period. Under such developments in the current and capital account of the balance of payments as well as due to generated unfavorable expectations of the economic agents the pressures in the foreign exchange markets become bigger.

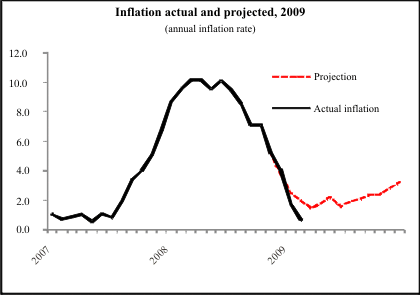

The fall in the external demand caused reduced activity among export-oriented industrial sector in the Macedonian economy. The volume of the industrial output in the last quarter of 2008 registered an annual drop of 7.6 percent, which intensified during January 2009, thus reaching 16.7 percent. Tightened conditions for credit as well as pesimistic expectations for the length of the recession reflect over domestic demand. Initial signs of a deceleration of household consumption growth are registered in trade, in which during q4, 2008 the amount of turnover registered dropped by 5.1 percent. In circumstances of private sector refraining from investments, the expectations are looking towards deceleration of the investment activity. In any case, the risks for the current projection of the economic growth definitely are in direction of the realization of growth significantly lower then projected, and maybe even that is a high optimism. In conditions of reduced import prices, the inflation continues to slow down, so that the average as well as the annual inflation rate for February equaled 1.2 and 0.7 percent, respectively. Inflationary developments within the first two months of this year show that inflationary path for this period is under the projected one. Such deviations, to a large extent may be explained with the fast decline of oil prices on world markets and with even faster deceleration of food prices. In conditions of risks for a possible bigger then expected deceleration of domestic demand, as well as due to higher reduction of import prices, risks about the projected inflation are towards realizing lower then projected level of inflation.

Figure 1

Inflation

(in %)

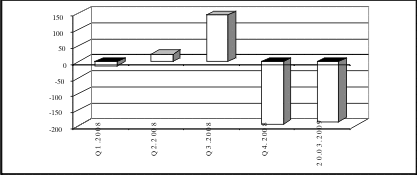

3) In the external sector during 2008 the highest ever current account deficit of 12.7 percent of GDP was realized, which is a significatn increase (by 5.5 percentage points) compared to the previous year, and to a large extent it is explained by the trade deficit worsening and reduced net inflows from private transfers. Yet, such a gap, during the most of the year has not created strong pressures towards NBRM foreign exchange market interventions, having in mind that in a significant part it was financed by direct investments, as well as through foreign assets of domestic banks. Hence, for the whole of 2008 the reduction of foreign reserves was moderate and mostly a reflection of developments in q4, (at worsened export performance, increased psychological influence due to world crisis and more significant outflow of dividend payout abroad). However, the projections for the reduced external demand and the uncertainties about the volume of 2009 capital inflows, announce widenning of the gap between the demand and supply of foreign exchange in the foreign exchange market.

Figure 2

Foreign Reserves

(change compared to previous quarter, in millions of euros)*

*The change in q4, 2008 includes the dividend payout of one large company to its foreign shareholder.

Figure 3

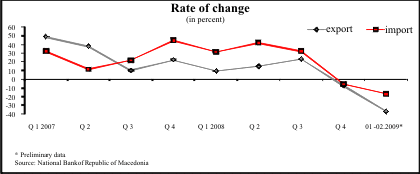

4) Developments in q1, 2009 show higher then expected worsening of the trends in the external sector. This corresponds to the continuous revisions of the projections of global developments, and is showing up through the further reduction of the gross foreign reserves. What exactly do the available data for the external sector show? First, in the domain of foreign trade, during the first two months of the current year exports and imports registered significant annual reduction of 36.8 percent and 16.6 percent, respectively. The reduction of the pressure on the trade deficit with the reduction of oil prices was offset through the drop in external demand, so although the deficit is within the expected range, so far still there is a risk of a higher then estimated trade deficit. Second, latest data show that net private transfers are lower then projected in conditions of growing demand for foreign exchange on the currency exchange market and of changes in the currency structure of the deposit potential. Third, certain indicative categories (stock exchange data on foreign investors' activities, developments of the net foreign assets of banks) indicate high probability of obtaining lower then expected capital inflows, which is consistent with more of global limitations on external financing.

Figure 4

Dynamics of exports and imports of goods

(annual changes)

IV. Presented trends from our economy undoubtfully confirm and justify the additional reaction of the National Bank of the Republic of Macedonia. As I stated, the reaction is towards the further tightening of the monetary policy. The characteristics of our economy and of the monetary strategy deriving from it, whose central objective is maintaining the foreign exchange stability, make the requests for undertaking anti-crisis measures similar to those of the developed countries, inappropriate and with no foundation. Therefore, we constantly repeat. The devaluation of the denar would cause additional distortions in our economy, because of the following:

- the structure of trade of the Macedonian economy characterises with high reliance of the export on the import of raw materials and manufacturing supplies, low representation of import goods that could be substituted with domestic products (machines and other equipment), weak price ellasticity of certain type of import demand (especially energy products), due to which the devaluation of the domestic currency will not reduce the problem of the structural trade deficit;

- On the other hand, the negative implications, that can be seen through the transmission effects of the devaluation of domestic currency on prices, further psychological pressures and the opening up of a new cycle of expectations for an additional depreciation of the value of the currency, will certainly appear and they will represent a potential threat for the price stability;

- Additional unfavorable element is the currency mismatch, i.e. the net indebtedness of domestic economy abroad, which clearly implies substantial negative effects from any possible depreciation of the domestic currency.

Therefore, the reaction of the monetary policy, by increasing the interest rate, is directed towards stabilization of the foreign exchange market, further maintenance of the foreign reserves at adequate level and continuation of the policy of stable foreign exchange rate. Obviously, the succesfull maintenance of the external balance imposes the necessity of appropriate and well coordinated measures by all the carriers of the macroeconomic policies. In this regard, the fiscal policy adjustments are important, also to obtain external financing to support the balance of payments. The NBRM, with the decision made today, for interest rate increase on the CB bills, is making an additional step towards reducing the external imbalance, and for achieving the interim and final objective of the monetary policy, remaining prepared to futher undertake additional measures, if necessary.

V. In the end, one more information. Today, the Council of the National Bank of the Republic of Macedonia held its 3rd session this year. Among other issues, on this session, the Council has adopted the 2008 Annual Report of the National Bank of the Republic of Macedonia; the 2008 Annual Report on Managing Foreign Reserves; the 2008 Internal Audit Report. All these documents shall be available on our web site in the following days.